- Home(English)

- Insurance Brokers

Insurance Brokers

The introduction of the insurance broker system in Japan

Following the amendment of the Insurance Business Act on April 1, 1996, the insurance broker system was launched. This system was introduced for the first time in Japan with a view to promoting international practices, and to improving user convenience by diversifying insurance distribution channels and by encouraging competition.

Insurance brokers in Japan play similar functions and roles to those in Europe and the United States. Generally, they are defined as “people who work to conclude optimal insurance contracts for policyholders based upon entrustment by each policyholder” and play a central role in insurance arrangements.

Insurance brokers, independent from insurance companies, fulfill intermediary functions in the purchase of insurance contracts in a prudent manner for clients who have entrusted them. This is a distinct difference from insurance agencies, which are agents of insurance companies. Insurance brokers are able to propose insurance policies from the client’s point of view as they do not belong to any insurance company. In designing policies, they not only review the conditions of insurance contracts and calculate the appropriate amount to be insured, but may even advise that “certain insurance plans for certain cases are unnecessary or inferior to other options”.

In other words, insurance brokers act as comprehensive risk consultants.

Authority of insurance brokers

Issuance of the insurance broker of record letter

Insurance brokers are independent from insurance companies and act as an intermediary in the conclusion of insurance contracts in a prudent manner for the client who has entrusted them. To keep a record, insurance brokers ask their clients to issue an “insurance broker of record letter.”

Broking of insurance contract

Insurance brokers can act as an intermediary in insurance contracts by presenting the “insurance broker of record letter” to the corresponding insurance companies. However, unlike nonlife insurance agencies, they do not have the legal rights to conclude contracts, receive declarations and/or notices from insured clients to-be, or receive premiums on behalf of insurance companies.

Obligation of good faith

Insurance brokers design optimal policies for clients and take responsibility for the recommendations made regarding the selection of insurance companies that provide optimal insurance coverage. This is the obligation of good faith required of insurance brokers under Article 299 of the Insurance Business Act.

Ensuring the capacity for compensation through security deposits, etc.

Moreover, as insurance brokers are independent from insurance companies, responsibility for damages caused to the policyholder, etc. in broking insurance falls upon insurance brokers, not insurance companies. Therefore, insurance brokers are required to ensure their capacity for potential compensation through security deposits, etc. (Article 291 of the Insurance Business Act).

Preparation of closing documents

When an insurance contract is concluded, insurance brokers prepare “closing documents”, which describe the names of each party, as well as the outline and date of conclusion as evidence of the concluded insurance contract contents and deliver them to the concerned parties (Article 298 of the Insurance Business Act and Article 546 of the Commercial Code).

Omission of closing documents preparation

When the concerned parties of the insurance contract (the policyholder and insurance company) have agreed in writing that closing documents will not be prepared, the preparation of the documents can be omitted (Article 303 of the Insurance Business Act and Article 237 (2) (ii) (c) of the Regulation for Enforcement of the Insurance Business Act).

Differences in broker and agency positions

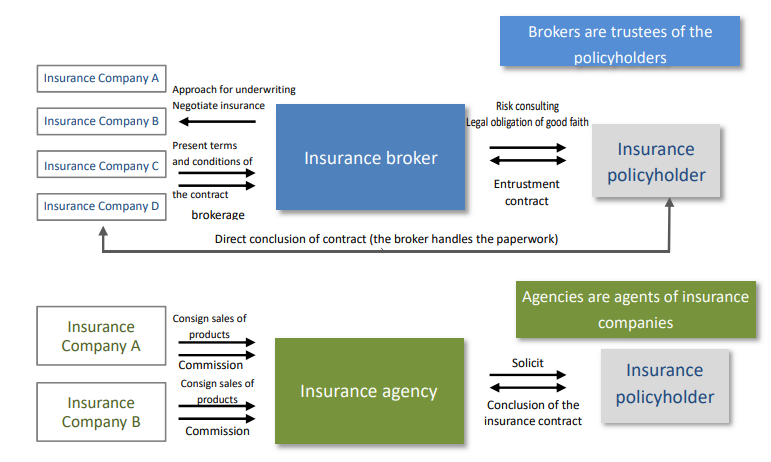

While agencies solicit insurance for insurance companies upon entrustment by insurance companies, insurance brokers act as an intermediary in the conclusion of insurance contracts for the benefit of the client based upon the entrustment by the client (policyholder).

The chart below summarizes the differences between insurance broker and agency positions.

Functions and roles of insurance brokers

Insurance brokers properly evaluate risks for clients based on professional knowledge and information related to the nature of risks and the insurance market, and select and negotiate with insurance companies in order to arrange insurance coverage with the most advantageous conditions that meet the needs of clients. Hence, the functions and roles of insurance brokers are to fulfill the legal obligation of good faith to clients and act as an intermediary in concluding insurance contracts.

Furthermore, when it is difficult to arrange insurance coverage that would meet the particular needs of an industry or customer, they also advise on alternative solutions.

It is often difficult for clients to compare and select insurance policies from several companies by themselves. Needless to say, it is even more difficult to compare, and appropriately decide to take out certain tailor-made insurance policies that are not provided to the public as standard by insurance companies.

Therefore, insurance brokers, as organizations independent from insurance companies, play functions and roles to provide fair advice to their clients. It can be said that this is a significant reason for utilizing the functions of insurance broker.