- Home(English)

- Utilization of insurance brokers

Utilization of insurance brokers

Utilization of insurance brokers

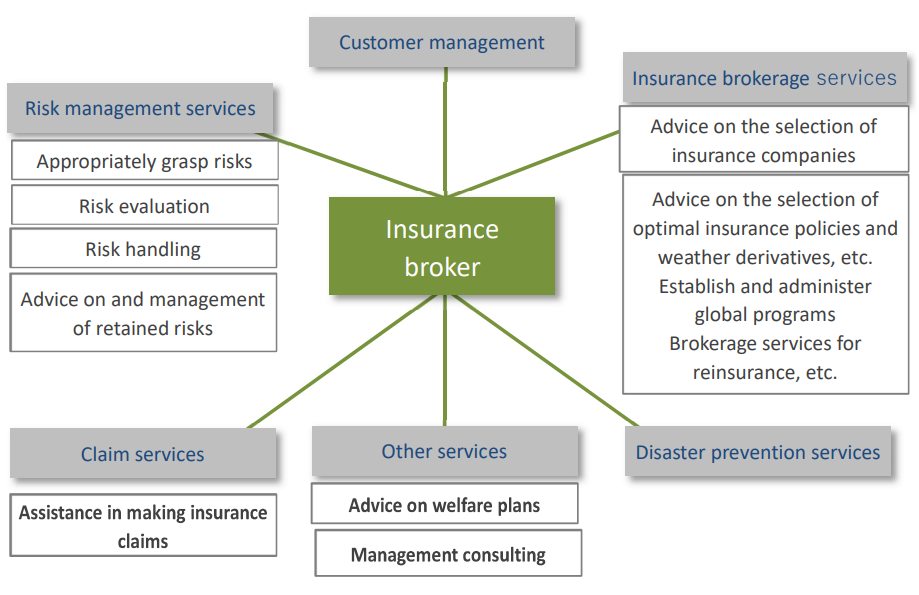

Insurance brokers provide various services to their clients, utilizing their specialized skills and knowledge. While the menu of services other than insurance brokerage services differs depending on the broker, the chart to the right represents usual services provided by insurance brokers.

Risk management support function

Insurance brokers are required to design optimal policies for clients and are held accountable for negotiations with insurance companies to obtain the optimal insurance terms and conditions from them. In this sense, their services are closely related to the risk management of their clients.

Insurance brokers analyze and evaluate various risks surrounding corporations and individuals from multiple angles, and propose optimal policies. In some cases, they propose methods they consider better than insurance. Some insurance brokers have a section specializing in risk management support within their group and handle risk management support for large-scale and/or highly-specialized business.

Types of insurance handled by brokers

Insurance brokers can act as an intermediary for policyholders in Japan in all types of insurance policies offered by licensed insurance companies in Japan (including small-amount short-term insurance providers registered in Japan). Furthermore, for the insurance types below, brokers are allowed to do broking of insurance contracts directly with overseas insurance companies that are not licensed in Japan.

- Reinsurance contracts

- Ocean marine hull insurance contracts

- Ocean marine cargo insurance contracts

- Commercial aviation insurance contracts

- Satellite insurance contracts

Handling new businesses

New businesses may be exposed to various risks that were never experienced in the past or by current traditional businesses. In order to make a new business successful and ensure the sustainable growth of a company, it is essential to carefully analyze and evaluate such risks well in advance and take sufficient measures to protect the company against them.

Unique projects and overseas businesses may involve risks that cannot be handled by insurance companies and agencies in Japan. In such cases, it is important to handle risks by utilizing the sophisticated risk-handling methods and international networks provided by insurance brokers.

In some large-scale projects, it may be necessary to appropriately assess the risks involved and ensure sufficient capacity directly underwritten within international reinsurance markets.

Insurance brokers assist businesses to succeed by presenting optimal risk-handling methods that fit the circumstances of clients to help them succeed in their new business, together with the professional knowledge and experience concerning various risks involved in such corporate activities.

Risk consulting services

Other than insurance brokerage services, risk consulting services, such as advice on risk analysis and evaluation as well as on the methods of risk retention and/or transfer, are rapidly becoming an important function of insurance brokers in recent years.

It is extremely important to accurately assess risks based on field surveys, and analyze and evaluate such risks utilizing risk-handling methods. Some insurance brokers have set up a specialized section for surveying risk and provide professional services given by risk engineers.

Insurance is, in many cases, the most effective and economical method of handling risk. However, purchasing insurance coverage does not always work well for all risks. Depending on the circumstances, risk handling methods other than purchasing insurance may be more appropriate, one example being owning and operating an intra-group insurance company known as a captive insurance company.

In addition to traditional risk transfer through insurance, insurance brokers, as comprehensive risk consultants, draw upon their expertise, risk handling skills, and tested advanced methods to support risk management for clients from multiple angles.

Reviewing insurance

Insurance reviews are usually conducted every year at the time of renewal. In most cases, however, substantial improvement is not made because such reviews are left with insurance companies or agencies and are conducted in line with existing insurance.

Insurance brokers, who are experts in risk handling, can appropriately assessthe risks of clients and objectively review insurance plans from client perspectives without being influenced by the insurance company’s sales strategy.

Insurance brokers propose insurance policies that are truly necessary for the client, which may lead them to advise eliminating unnecessary or excessive insurance coverage as well as encouraging the improvement of the content and its cost-effectiveness.

In particular, companies with a large number of domestic and overseas offices and affiliates often arrange tailor-made insurance coverage. By comprehensively reviewing group-wide, worldwide insurance from specialized and global perspectives, client companies can enjoy considerable benefit.