- Home(English)

- About JIBA

About JIBA

Greetings

We appreciate your visit to the Japan Insurance Brokers Association’s official website. The insurance broker system was introduced as a registered and authorized business class defined by the Insurance Business Act on April 1, 1996. The Japan Insurance Brokers Association (JIBA) was established on December 9, 1997 and was reorganized as a general incorporated association as of April 1, 2009.

Insurance agencies act on behalf of insurance carriers, while insurance brokers act for the benefit of their clients. Insurance brokers, independent from insurance companies, function as an intermediary in the conclusion of insurance contracts in a professional and prudent manner for the clients who have entrusted such a role to them. This is one of the most distinct differences from insurance agencies, who are agents of insurance companies.

Insurance brokers are appointed by clients and are intermediaries for insurance contracts, acting in good faith for the benefit of clients. Providing the best advice to the clients is the core duty of insurance brokers. To perform their duties, insurance brokers have to work as consultants for their clients by providing advice in a neutral and fair manner. In some cases, risk transfer to insurance carriers may not be the best solution from the standpoint of the clients.

The development of our interconnected and innovative world, including the rapid expansion of the internet, has caused businesses to require and seek for more sophisticated and diversified risk management methods. For instance, business enterprises operating overseas must be aware of the unique and unfamiliar risks in the countries and regions where they plan to expand their business. In this respect, insurance brokers help their clients understand local business customs and insurance business laws, and enable them to succeed in their expansion.

In an aging society in Japan, the need for life insurance and non-life insurance for individuals will increase. In addition, the need for protection from natural catastrophes will also increase, as the frequency and the severity of disasters in Japan and throughout the world continue to rise. As true advocates for businesses, we believe insurance brokers are the best partners to help you assess your risks and choose the best risk management solution for your current and future business.

Corporate Profile

| Corporate Name | Japan Insurance Brokers Association |

|---|---|

| Address | Sanyu-tokiwabashi Bldg. 8th Fl. 3-5, Nihonbashi-hongokucho 3-chome, Chuo-ku, Tokyo 103-0021 Tel: +81-3-6262-6400 Fax: +81-3-6262-6401 Email: jiba-cert@jiba.jp Map: View map |

| Objectives | Prepare for higher responsibility as a self-regulating organization Help expand insurance brokers’ market Increase the number of member companies and broker license holders Support expanding international business for insurance brokers |

| Measures |

|

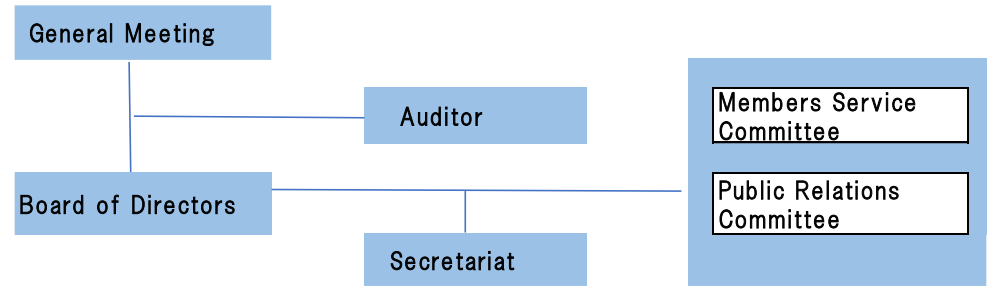

Organization Chart

Directors

| Chairman | Satoshi Kasseki (Nippon Souken Co., Ltd.) |

|---|---|

| President & CEO | Satoru Hiraga (Marsh Broker Japan, Inc.) |

| Deputy President | Yoshiyuki Sogawa (Ark Insurance Brokers Inc.) Makoto Komachi (Mitsui & Co. Risk Solutions Ltd.) |

| Executive Director | Yoshio Miyatake |

| Director | Yoshihiko Muneta (Kyoritsu Insurance Brokers of Japan Co., Ltd.) Katsuya Tanimizu (Aon Group Japan Ltd.) Kazuhiko Shinkai (Cosmos Risk Solutions Co., Ltd. ) Akihiro Soejima (ARM Consulting Co., Ltd.) Yoshihisa Seko (Ginsen Risk Solutions Co., Ltd.) Horoshi Yamamoto (MST Risk Consulting Co., Ltd.) Masanori Shibata (Toyota Tsusho Insurance Management Corporation) Kenichi Nakamura (SC Risk Solutions Co., Ltd.) Yukihiro Okabe (Marnix Corporation) Daisuke Nakahara (World Insurance Brokers Corp.) |

| Auditor | Toru Kojima Jun Yamaguchi |

Members Service Committee

Objectives

- Conduct insurance broker qualifying examinations

- Prepare and review educational and training programs

Public Relations Committee

Objectives

- Promote insurance broker business

- Conduct public relations activities

- Review qualification for membership

- Review and maintain professional code of ethics and code of conduct

- Help new insurance brokers with their registration

- Prepare standard business procedures and documentary forms